Home prices in Britain will come under pressure in 2017 because housing has become increasingly unaffordable.

Martin Ellis, housing economist from Halifax, said in a statement that while prices will be supported by the nation’s evergreen problem of a lack of housing supply and cheap credit, demand will be dampened because people are struggling to truly afford buying a property (emphasis ours):

“House prices finished 2016 strongly. Prices in the final quarter of the year were 2.5% higher than in the previous quarter. The annual rate of growth increased, rising for the second consecutive month, from 6.0% in November to 6.5%.

“Slower economic growth, pressure on employment and a squeeze on spending power, together with affordability constraints, are expected to reduce housing demand during 2017. UK house prices should, however, continue to be supported by an ongoing shortage of property for sale, low levels of housebuilding, and exceptionally low interest rates.

“Overall, annual house price growth nationally is most likely expected to slow to 1-4% by the end of 2017. The relatively wide range for the forecast reflects the higher than normal degree of uncertainty regarding the prospects for the UK economy this year.”

The main reason for house prices rocketing over the last decade is due to Britain’s major housing shortage.

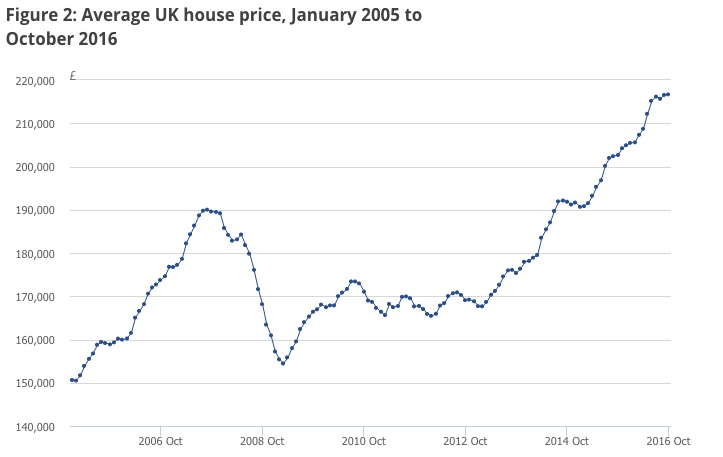

Here is a key chart from the Office for National Statistics:

If there is too little supply but huge demand, then prices will go up.

On top of that, cheap credit helps people to buy a property because borrowing money is cheaper. Interest rates have been at a record low since 2009 and in August this year, fell to 0.25%.

The average UK house price is now at £222,484, according to the Halifax. Meanwhile, the ONS has London house prices hovering around £600,000.

But there comes a sticking point.

More people are buying homes because of cheap credit, but supply is still tight, boosting demand and exacerbating the market imbalances - further catalysing house price rises.

In tandem, if wages do not rise at the rate of house-price growth, then buying a property becomes more and more unaffordable. That is basically because people aren't able to save up for an average 10% deposit to buy a home, even if they could manage to scrape enough together to ensure they could pay their mortgage repayments.

This is what is happening right now.

This chart shows how the house price to earnings ratio is continuing to rise. This shows the number of times you have to leverage your income to buy a home: